01/12/2026

CRB Announces Third Workshop in Laboratory Management & Leadership Excellence Series

11/14/2025

Register Now for the January 22, 2026 Webinar: How to Advocate on Federal IVF Policy

09/22/2025

AAB Releases New Andrology & Embryology Review Manual and General Knowledge Review Manual

06/11/2025

Introducing SCALE: Synergistic Cooperative for ART Laboratory Excellence

05/30/2025

Register now for the 2025 Andrology & Embryology and General Knowledge Review Courses

05/30/2025

CRB Meets With CMS Officials To Discuss CLIA Accepting Animal Science Degrees

05/07/2025

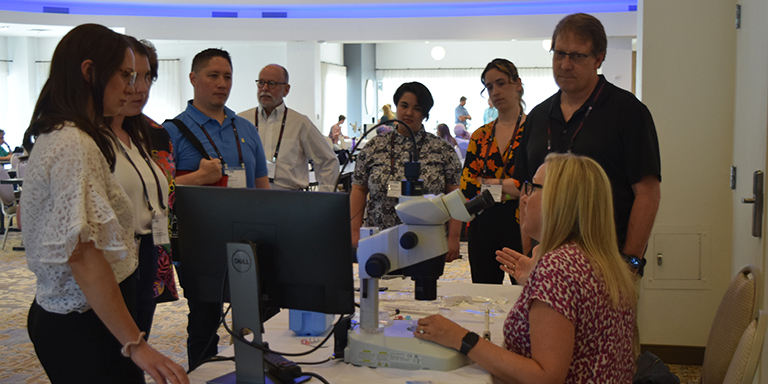

CRB Announces 2025 Laboratory Management and Leadership Development Workshop

04/21/2025

CRB Announces Winners of Embryologist Video Contest

04/04/2025

FDA's LDT Regulations Struck Down by Texas Court

03/26/2025

Complete the CRB Membership Survey

03/25/2025

Read the New CRB Newsletter, Vol. 14, No. 1

03/11/2025

CLIA Webinar Recording Available to CRB Members

01/29/2025

Clinical Laboratory Technologist (CLT) Committee

01/23/2025

Register Now for the 2025 CRB Symposium & AAB Conference